Figure 1: In a world dominated by rapid market fluctuations and overwhelming data, this simulation visualizes deep reinforcement learning models that navigate through the turbulent waters of algorithmic trading, skillfully making buy and sell decisions.

Imagine a dynamic visualization where lines and bars representing market trends and trading activities shift dramatically across the screen. This visual isn’t just a representation of market data; it’s a window into the sophisticated world of financial technology explored in my thesis at The University of Sheffield.

This project merges cutting-edge technology in deep reinforcement learning with an understanding of market sentiment and technical indicators, pushing the boundaries of what algorithmic trading can achieve.

Why Deep Reinforcement Learning in Trading?

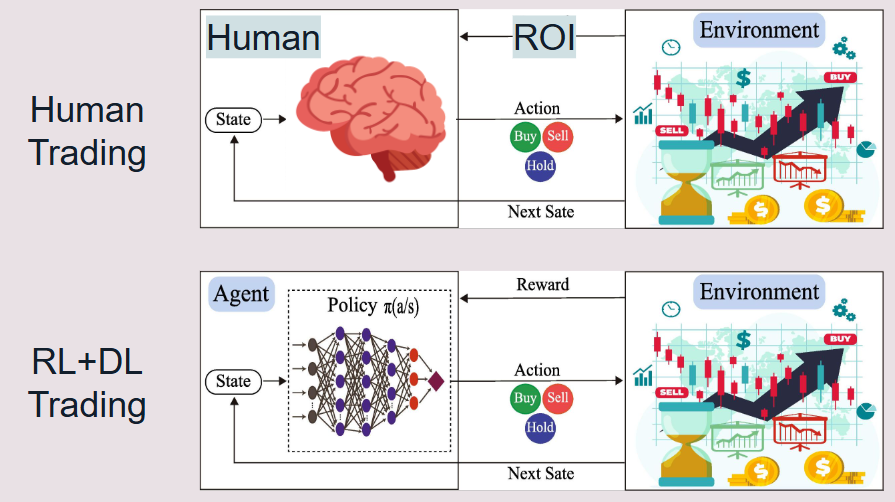

Incorporating deep reinforcement learning (DRL) into trading strategies isn’t just an upgrade—it’s a revolution. Traditional trading algorithms, while powerful, often lack the adaptability needed in today’s volatile markets. However, DRL thrives in these conditions by continuously evolving its strategies based on real-time data, ensuring timely and topically relevant decisions.

DRL consists of combining reinforcement learning, a learning process found in all living creatures with any remote intelligence, and deep learning, which utilizes layered neural networks capable of processing vast amounts of data.

This combination allows DRL to adapt to complex market environments dynamically, learning from past experiences to make predictive and proactive trading decisions. Unlike static trading algorithms that follow predetermined rules, DRL models adjust their strategies as market conditions change, leading to potentially more profitable and less risky trading outcomes.

By integrating both historical data and real-time market signals, DRL models can recognize patterns and anomalies that might provide an advantage over traditional algorithms. This capability is crucial in managing the kind of unpredictable fluctuations seen in today’s financial markets, where conventional approaches might struggle.

Furthermore, DRL’s ability to simulate countless trading scenarios helps refine strategies to a granular level, optimizing decision-making processes over time, which is essential for maintaining a competitive edge in high-stakes trading environments.

Understanding the Integration of Sentiment Analysis

Central to my approach in this project is evaluating the potential advantage of integrating sentiment analysis insights, into decision-making regarding machine learning trading. Using this series of information as an additional indicator or in mathematical terms, reducer of entropy allowed my models to gauge market mood, which when combined with quantitative technical indicators, creates a robust trading strategy that traditional models cannot match.

The calculation of the sentiment score is critical to my approach, enabling the models to integrate market mood into trading strategies. The sentiment score for each article is derived using the following formula:

![]()

The Role of Technical Indicators in Enhancing Predictions

To ensure my trading models were not just reactive but predictive, we incorporated a variety of technical indicators such as price patterns extracted using an algorithm I created to track highs and lows, and volume trends. These indicators serve as the quantitative backbone of my trading strategies, offering a structured way to predict market movements.

So What Did I Do?

Using a combination of Python and specialized machine learning libraries, I implemented these methodologies to create simulations that not only predict market trends but also execute trades in a simulated environment. These simulations help us understand potential outcomes in various trading scenarios, providing valuable insights into both the effectiveness of my strategies and the behaviour of the markets themselves.

In My Simulated Environment…

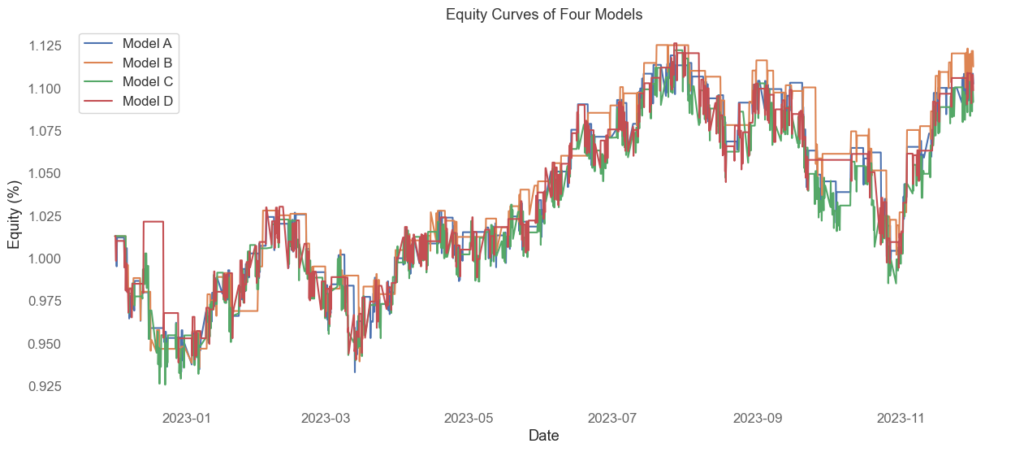

Each model was specifically designed with different combos of features that allow us to compare features’ effects fairly:

- Model A: Only given price data.

- Model B: Only given price data and market structure features I extracted.

- Model C: Only given price data and sentiment data

- Model D: Given price data, sentiment data, and market structure features.

Results and Findings

The performance graphs of each model are displayed in the figures below, showing how different strategies play out under various market conditions.

For instance, Model B consistently outperforms others in bull markets, illustrating the lack of effectiveness in integrating sentiment data. However, this lack of effectiveness may have been due to many factors, hence not necessarily ruling out the potential benefit of integrating sentiment data.

Conclusion

The sophisticated techniques used in deep reinforcement learning models, enhanced by the precision of real-time sentiment analysis and technical indicators, offer a compelling tool for predicting and navigating the complexities of financial markets. This thesis not only showed the potential of integrating DRL in trading but also set the stage for further innovations in financial technology.